The growth of coworking in Denver, and the rest of the world at that, has been a major buzz topic in the world of commercial office space. The coworking industry has taken the world by storm over the past decade. To put this in perspective, the total number of global coworking spaces in 2005 was a mere 3. Today there are over 15,500 coworking spaces worldwide. The industry has grown over 200% in the past 5 years and major brokerage firm JLL predicts by 2020, up to 30% of all office space will be some form of shared office concept. These numbers are promising and should reflect the demand and desire for conducting business in a coworking space.

But growth is not the only change the industry is going through. The industry as a whole is going through major shifts, its

differentiating and offering more than ever before. The original coworking concept set back in the early 2010’s is but a shadow of the newer concepts of the coworking space in Denver. Now, we say Denver because this is the market we

know best. So the following sections will describe the industry shifts we are seeing in Denver, but can be applied to the industry as a whole.

More Suites

As owners who’ve also been active coworkers throughout the years, it’s easy to mourn the loss of more pure communal spaces. After all, the trend in coworking since 2012 has been to add more and more private offices into new shared offices and we can’t control it. In Denver alone, 87% of new coworking and shared office environments are made up of private

offices.

This number is higher for coworking spaces in Denver proper, but drops as you move out from the city center. Many coworking spaces on the fringe of the suburbs still offer a majority common space.

Competition

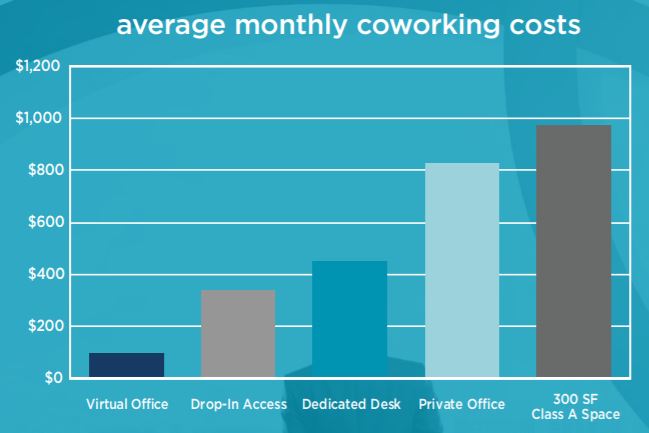

Competition is driving costs down for those coworking in Denver. Up until a year ago most full time coworking plans had cost between $300 and $350 a month in Denver and most of the bigger cities in the US. We are now seeing this number decrease to as low as $99/month for full-time hot desk members.

Overall, this is good for coworking. As a maturing industry, this competition will force all of the coworking communities to differentiate based on personality, vibe, valuable relationships, events, space design, etc. This is also great news for Denver coworking members that want better spaces and more affordable rates.

Who Works in

Coworking?

As the industry grows older, so does the average age of its members. The current average age of coworking space members is a little over 36 years, compared to 35 years in the previous year (Deskmag). The oldest members are entrepreneurs with staff (employers: 40 years), followed by freelancers (38 years). On the other hand, employees are at the average age of

33 years.

When it comes to member industry, members in IT jobs are still the biggest group and were able to slightly increase their ratio compared to the previous year (20% to 22%). More often than before, you will now also find professionals who work in PR, marketing & sales in coworking spaces (8% to 14%). The relative share of consultants on the other hand has dropped significantly from 11% to 6% (Deskmag).

Big Corporations in

Coworking

The average person typically thinks of companies in coworking spaces as small businesses, startups and the single entrepreneurs. However, due to the many collaborative benefits and cost savings coworking provides, larger, established corporate companies are switching to coworking spaces. Salesforce, Starbucks, Microsoft, Facebook, and Bank of America are just some of the big names making the switch. A recent report even noted that 25 percent of the annual WeWork revenue is from companies with more than 1,000 employees worldwide.

So, what are some of these driving factors for big companies making the switch? For one, it’s the collaborative aspect. The shared workspace offers these corporations access to innovators in their field, to startups with industry-changing ideas and talent.

Coworking is also cheaper than traditional office space. Instead of having to rent office space, buy furniture, pay for utilities and internet, buy office equipment, and provide coffee and snacks, corporations find it easier to pay a monthly fee to the coworking company and not have to deal with those additional pains of pocket.

Coworking is Good for All

Below are some numbers from the Global Coworking Survey on coworking member well-being:

- 89% of members reported feeling overall happier

working in a coworking space. - 79% say coworking has expanded their social

network. - 82% report coworking has expanded their

professional network. - 84% claim to be more engaged and motivated at

work. - 64% said their coworking network was an

important source of business leads and referrals. - 80% said they had turned to other coworking

members (outside of their company) for professional help and guidance.

Coworking Expansion

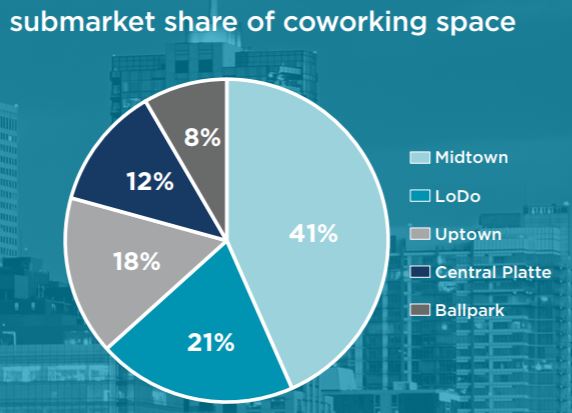

According to the Cushman & Wakefield Q3 Coworking Report, “at the beginning of 2015, there was only 21,381 square feet of coworking space in Denver. Since then, more than 607,000 square feet of coworking space has been added with more than 117,000 already in the pipeline to open in 2019. Each year has added an increasingly larger amount with roughly 98,000 sf added in 2016, more than 158,000 sf added during 2017, 189,000 sf in 2017 and more than 206,000 SF YTD already in 2018.”

This trend is expected to continue through 2019 with already half of the current 2018 total already met. Let’s find out how coworking tenant demand is driving this growth.

Business Savings

Perhaps the largest driver for tenants seeking coworking space is the savings it provides. Coupled with the added amenities that are provided with this up-front cost, small and large companies are weighing coworking facilities as a strong alternative during their search for real state.

Supply (Central Business District Only)

While many different coworking spaces have opened in Denver’s Central Business District (CBD), WeWork has dominated the 745,291 SF market with a 51% share at 384,282 SF, including their Wells Fargo location, scheduled

to open this year. They have also embraced the large coworking space model as even their smallest location exceeds the CBD average of 41,011 SF. Enterprise Coworking in RiNo, for comparison, occupies a total of 66,000 SF, making it the 5th

largest coworking facility in the Greater-Denver area.

What does the future hold? Coworking currently accounts for only 2.7% of the total office space inventory throughout Denver’s CBD, but 96.6% of that has been added in just the past four years.

Estimates put the total amount of coworking space nationally at about 32.5 million SF, excluding executive suites models such as Regus, which would mean Denver represents about 2.3% of the entire US coworking market. As Denver has evolved into a tech city and startup hotbed, it is expected that coworking in Denver will continuing to expand at an increasing rate as demand continues to grow.

Suburban Spread

Coworking in Denver is not at all limited to the CBD however. Enterprise Coworking, for example, has its RiNo coworking space and a space down in the Denver Tech Center and Greenwood Village. And we’re not alone. The development of the RiNo neighborhood has been near-exponential in the past decade, attracting industries of all kinds to the vibrant arts neighborhood. Coworking spaces outside the CBD are also more likely to have a larger square foot per member and onsite parking.

But coworking spaces are expanding even past the closest Denver neighborhoods. The DTC and Greenwood Village area is now home to a handful of spaces including the second location of Enterprise Coworking. Boulder has expanded its coworking arsenal in the last 3 years and, according to Google Trends data, now we’re seeing a high demand along the 36th corridor, connecting Denver and Boulder.

Location has been found to be the single most important factor in determining which coworking space a person chooses. In fact, location is 60x more important than brand, meaning people will almost always choose a close, local brand over the popular WeWork that requires a 45-minute commute into downtown Denver. As more people become aware of the coworking industry, the demand for suburban coworking spaces increases. As jobs become more flexible and the average coworking member gets older, there’s going to be an expectation to bring these workspaces closer to the consumer.

What Can We Expect in 2019?

Niche Spaces

We will see niche spaces play a big role as competition continues to grow for coworking in Denver. The rise of women-only coworking spaces continues, but we also see spaces for technology, industries, political movements etc. High-end luxury brands will continue to thrive as well as brands that can play to the desires of the startups on budget.

Consolidation

With a maturing coworking market, an influx of investment money, and a strong economy, we will continue to see brands grow, expand and consolidate. We’re already seeing new franchises such as Worklodge come to the market, and in

China, URWork has almost run out of competitors to buy. In some tight markets, such as Austin, Texas brands will

buy existing brands to maintain their presence. We’re not seeing too many coworking spaces in Denver be bought out just yet, but as this trends with the rest of the world, we could start to see consolidation this year.

Well-Being

There will be a major focus on health and well-being in the workplace. According to a recent study, our work is literally killing us. it found that the workplace is the fifth leading cause of death in the U.S. We are facing a global crisis in

mental health. The World Economic Forum reports that depression is the number one cause of ill-health and disability worldwide, with an estimated 300 million people suffering from it. A focus on wellness will continue to make a huge

impact on space design, from the building, to the air and light, as well as in services offered to members. Being WELL Certified will become a staple in building design.

Each year the coworking landscape takes some new turns. As an industry still in its infancy, its exciting to see where we’ll end up a decade down the road. The trends point toward a global workforce of coworking members. The safest bet is that the workplace of the future will look somewhat of a hybrid between traditional and flexible office space. With larger corporations switching to the coworking model and the differentiation of the industry, its easy to tell that coworking in Denver will be embraced by more and more as the years go on.